Why Forex Trading Takes Place 24 Hours A Day

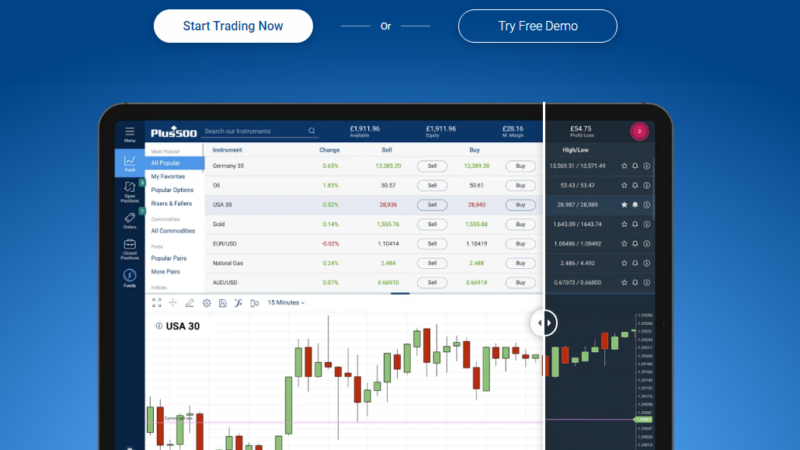

The forex market is the largest financial market in the world, with an average global turn over 5 to 6 trillion US dollars each day. Forex trading is not done at one central location but rather between participants by phone and by using electronic communication networks in several markets around the world.

International currency markets are made of banks, central banks, investment management firms, commercial companies, hedge funds, as well as retail brokers and investors around the world. The forex market can be accessed at any time from any place (except during the weekend break) because this market operates across multiple time zones. An extensive network of exchanges and brokers around the world keep exchanging all the time, meaning that the forex market is not governed by single market exchange. The trading hours of forex are based on when the trading is open in each participating country. The busiest time zones on the forex market are London and New York. The time when the time zones of these two trading sessions create the most active time on the forex market.

While some currencies are traded continuously for the entire time the market is open, some other currencies are traded at only specific time intervals. These are called exotic currencies, and the currency pairs involving exotic currencies are called an exotic pair. Exotic pairs are the least liquid and are therefore not traded often. However, the most traded currencies are the US dollar (USD), the Canadian dollar (CAD), the Japanese Yen (JPY), the Euro (EUR), the Australian dollar (AUD), the Swiss franc (CHF) and the New Zealand dollar (NZD).