What is DSO Days Sales Outstanding? Formula & DSO Calculation

Content

Having a DSO greater than the standard payment terms indicates the company is not collecting money from its customers on time. Because of this, management will have less money available to spend on operating activities. In order to decrease the DSO, changes will need to be made to the accounts receivable department to increase efficiency. A high DSO means just the opposite – with a long waiting period before converting credit sales to cash, it is more difficult for the company to cover expenses and have extra capital for business investments. The days-sales-outstanding formula divides accounts receivable by total credit sales, multiplied by a number of days in a measurement period.

How do you calculate days sales outstanding?

To calculate DSO, divide the total accounts receivable for a given period by the total credit sales for the same period, and multiply the result by the number of days in the period. Days Sales Outstanding = (Accounts Receivable/Net Credit Sales)x Number of days.

This is a deceptively complex metric, giving you a prime opportunity to leverage automation to drive efficiency. Get a better understanding of when you experience higher DSO trends so you can resolve issues alongside your partners in accounting and customer success. Now, we can project A/R for the forecast period, which we’ll accomplish https://www.bookstime.com/articles/days-sales-outstanding by dividing the carried-forward DSO assumption (55 days) by 365 days and then multiply it by the revenue for each future period. The first step to projecting accounts receivable is to calculate the historical DSO. It is technically also more accurate to only include sales made on credit in the denominator, rather than all sales.

How a Good O2C Process Supports Good DSO

It’s easier to evaluate financial health after weighing all these factors together. The current dollar amount of open invoices, based on days since the invoice date. Over the course of the projection period, the company’s management team expects revenue to grow at a constant rate of 10.0% each year.

QuickBooks Online makes it easy to track the status of your invoices, from when they’re sent, viewed by your customers, paid, and deposited into your business bank account. Invoices are sorted by status, with overdue invoices listed first, making it easy to see who owes you. Including information on your invoices like due days, payment terms and options can help keep you and your customers on the same page. Use an invoice template that includes all of these important details, like the invoices generated by QuickBooks’ free invoice generator, or free invoice templates.

Offer discounts for early payment

Regardless of the business, it is usually best to have a low DSO, so companies quickly collect money from the sales they have already made. Because of the time value of money concept, every day that passes without collecting on accounts receivable is money lost. Additionally, when revenue is not quickly gained after the sale, the company has less money to pay for its expenses and business investments while waiting for the credit sales to come through. In a nutshell, the days sales outstanding (DSO) ratio is an essential metric that B2B-centric companies need to track in order to assess the financial health of their businesses consistently.

You may also lose out on an opportunity to expand or otherwise enhance your business because you won’t have the cash to invest. If your business has a high DSO, consider evaluating your credit policies, including to whom you extend credit. If your DSO begins to climb, it may mean more of your cash is tied up in accounts receivable. If all sales were made on Net 30-day terms, the Best Possible DSO would be 30. If all sales were made on Net 60-day terms, the Best Possible DSO would be 60. If half of sales were made on Net 30 terms and the other half on Net 60 terms, the Best Possible DSO would be 45 days (terms weighted by the proportion of total sales).

Explore Related Metrics

But it also important to take a look at the numbers underlying your calculations to ensure that you have an accurate picture of a company’s performance. For more ways to improve your cash flow, download the free 25 Ways to Improve Cash Flow whitepaper. [box]Strategic CFO Lab Member Extra

Access your Cash Flow Tuneup Execution Plan in SCFO Lab. There is no definitive answer to this question, as it varies from industry to industry.However, as a general rule of thumb, a DSO of 45 days or less is considered to be good. This can create a cash flow problem and make it difficult to maintain good financial health.

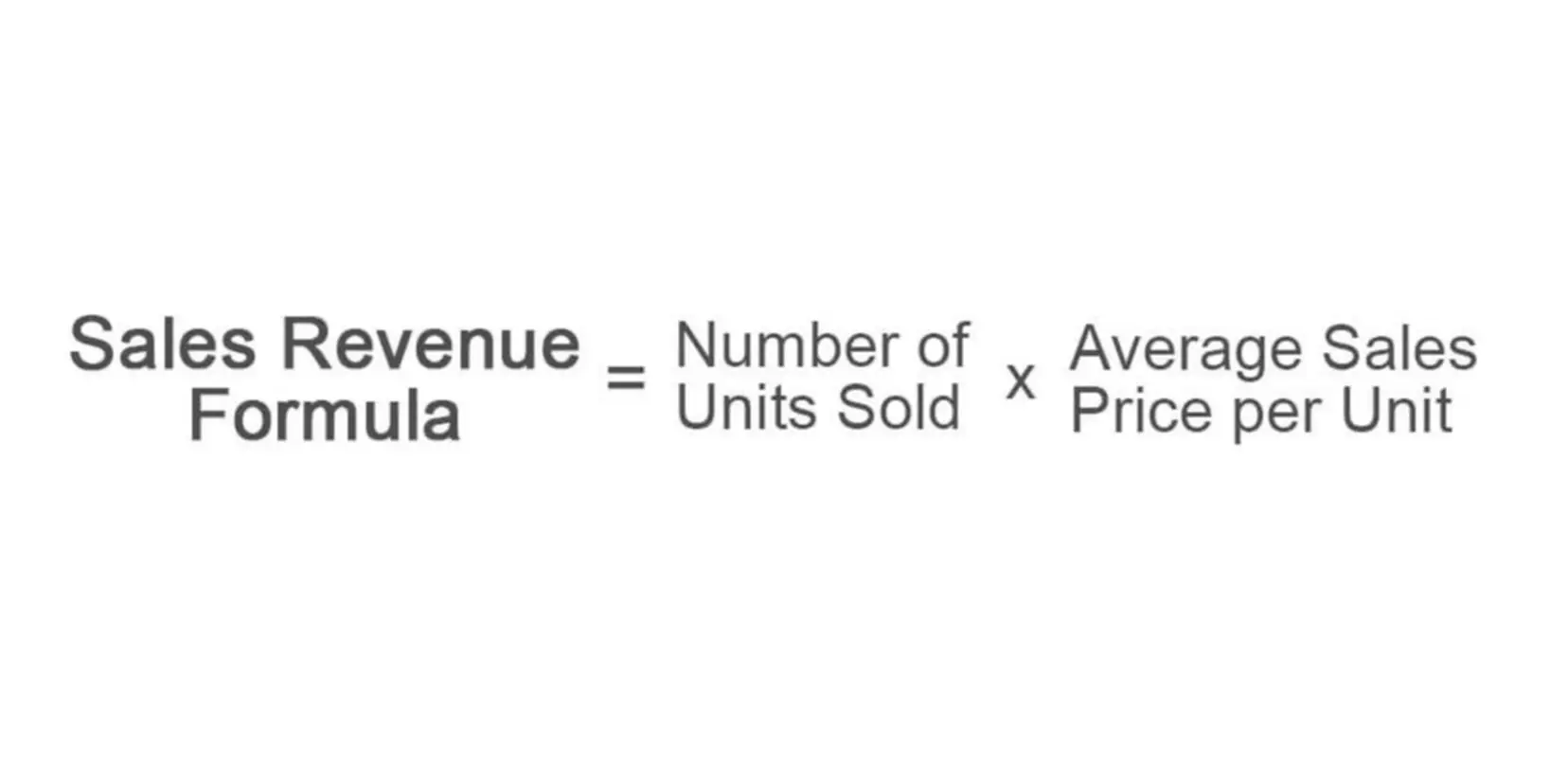

How do you calculate sales from DSO?

The formula for your days sales outstanding calculation is your average accounts receivable balance divided by revenue for the given period of time, all multiplied by the number of days in the period.

– Devising better strategies motivating the payment collections department to maintain a strong proactiveness in keeping outstanding accounts receivables at a minimum. Due to the importance of having a healthy operational cash flow when running a company, it would be in the firm’s best interest to ensure that it collects all outstanding accounts receivables as soon as possible. Simply put, DSO is a key performance indicator (KPI) used to study the company’s accounts receivables. In essence, tracking the DSO would be extremely advantageous to the business once they have comprehended the procedure behind its calculation. DSO is valuable as a shorthand indicator that helps a company understand how their accounts receivable collections process compares to others in their industry. Changes in DSO (up or down) reflex changes in key inputs from a company's balance sheet.

Calculate total credit sales for the period

In general terms, a DSO of less than 45 is considered good, but this can vary between industries. For example, a manufacturer selling heavy equipment is more likely to have a higher DSO than a service business. So, it is essential to note that while trying to reduce DSO, you should consider what works best for customer satisfaction and what competitors offer. Applying the following methods can lower the DSO for small companies with a higher value than the generally accepted 45. What qualifies as high or low depends on the business type and the industry.

What is DSO and DPO formula?

DSO = ($95 / $9,000) x 365 days = 3.9 days. DPO = $850 / ($3,000 / 365 days) = 103.4 days. CCC = 182.5 + 3.9 – 103.4 = 83 days.

If you're using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR for 15 months, an insane cash back rate of up to 5%, and all somehow for no annual fee. Though a low DSO is preferable, what constitutes a low DSO is dependent on the industry. For example, the financial industry often has comparatively higher DSO ratios, but businesses within the financial industry should aim to have low DSO ratios compared to their competitors.

Given the caveats above, collections and the entire order-to-cash (O2C) process have much to do with DSO. A company that does not send it invoices until a week after the product has shipped is adding days to its DSO. The sooner you receive payment for a sale, the sooner you have cash available to reinvest in your business. Your company’s cash flow is crucial for businesses, as it allows them to pay their own bills on time and avoid taking out loans. A healthy or concerning DSO ratio would largely depend on the nature of the business and the industry verticals in which the firm is operating. To assist companies with achieving such goals, finance professionals ought to consider using a smart credit control platform called Kolleno.