I can easily see copper over $5 in 2025, The timing will be great, we’ll hit the wave Osisko Metals Robert Wares

Although it has similar properties to gold and silver, copper is significantly cheaper. The global copper supply is fueled by mining and recycling of copper products. When mined, copper is extracted from crushed ore Is trading legal and is furthered refined through smelting. Copper prices are determined by the demand for copper, primarily commercial.

Key data points

- You can also learn about the national economies of countries like China and India, both of which are key players in the copper market.

- Although it has similar properties to gold and silver, copper is significantly cheaper.

- It’s mainly used in electrical wiring, roofing, plumbing, and cooking utensils.

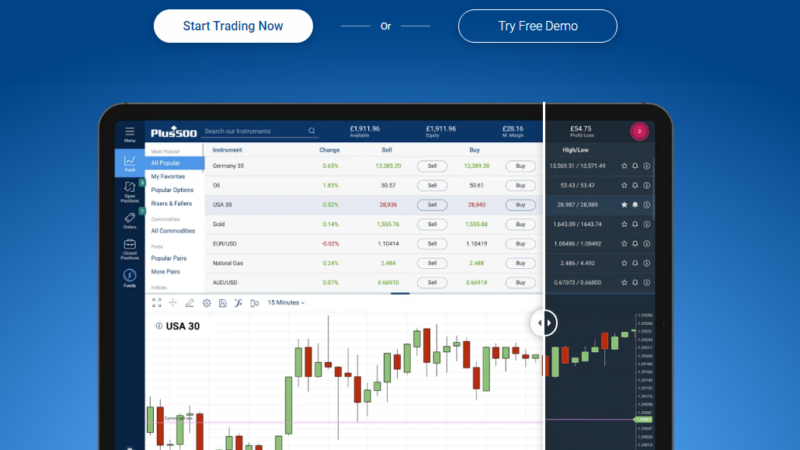

- Different exchanges and brokers list different live copper prices because of several reasons.

For example, the Copper Futures price on Comex is different from what you see on the London Metal Exchange (LME). The price of copper may depend greatly on the ability of these countries, as well as other emerging economies like Brazil. A halt of growth in emerging economies would almost certainly have a negative effect on copper prices.

You can also why do devs get into fintech 5 reason to be a fintech developer and learn about the national economies of countries like China and India, both of which are key players in the copper market. Finally, natural disasters like earthquakes and landslides can slow down mining output. Copper traders should pay attention to geopolitical news that affects the mining industry.

In the case of brokers and copper derivatives, the spread charged on the copper instrument may also contribute to the price difference. Marko has been working on the road for over 5 years, and is currently based in Europe. Alongside writing and editing, Marko works on projects related to online technology and digital marketing. Nickel, lead, and iron also competes with copper as substitutes in some industries. Cheaper metals such as aluminum are now a substitute for copper in power cables, electrical equipment, and refrigeration equipment. Events like miner strikes can also produce supply disruptions and higher prices.

Rising threat of World War III could see gold hit $2,800 by Christmas – analyst

You can see historical copper prices, real-time price and the metal’s year-to-date performance at the top of the page. Different exchanges and brokers list different live copper prices because of several reasons. In the case of exchanges, the market maker and data provider may be different.

Data Suggestions Based On Your Search

One troy ounce is rounded to 31.1 grams — this unit is typically used on exchanges and by bullion dealers. Because infrastructure represents such an important part of the demand, emerging markets are a key driver of copper prices. Fast-growing countries like India and China are accumulating vast amounts of wealth as their economies grow. It’s mainly used in electrical wiring, roofing, plumbing, and cooking utensils. Copper’s widespread usage began during the Copper Age, from 3500 to 2300 BCE. The metal was initially used exclusively in its pure state but was later used in the production of other metal alloys.

Read on to find out about how copper prices compare to precious metal prices like gold and silver. We also explain the main price drivers of copper, how you can get copper via bullion dealers, and how you can keep up with copper price news. The most common weight units to measure copper are pounds (lb), standard ounces (oz), troy ounces (t oz), and grams 5 essential networking commands (g). For copper commodity market prices for trading — you’ll find copper listed in pounds (lb).

Metal Spot Price Charts Copper Price Chart (USD / Pound) for the Last Year

Such demand is driven by the construction and technology industries. Then, the rate of supply through copper mining and production determines what price the commercial consumers pay. Future projections of copper supply and demand are available via various resources. The building construction industry is responsible for close to half of the US copper supply. Speculators should pay close attention to trends in this market for clues about future copper prices.

Copper bullion might be harder to purchase than the likes of gold, silver, platinum, or palladium since it’s not classified as a ‘precious metal’. Historically, countries in this region have occasionally chosen governments that nationalized the mining industry. Political, environmental, and labor issues can have a big impact on copper prices. South America supplies a significant amount of copper, particularly Chile and Peru. The economic principle of substitution represents a risk of investing in any commodity, and copper is no exception. As prices climb, buyers will seek cheaper substitutions, if available.