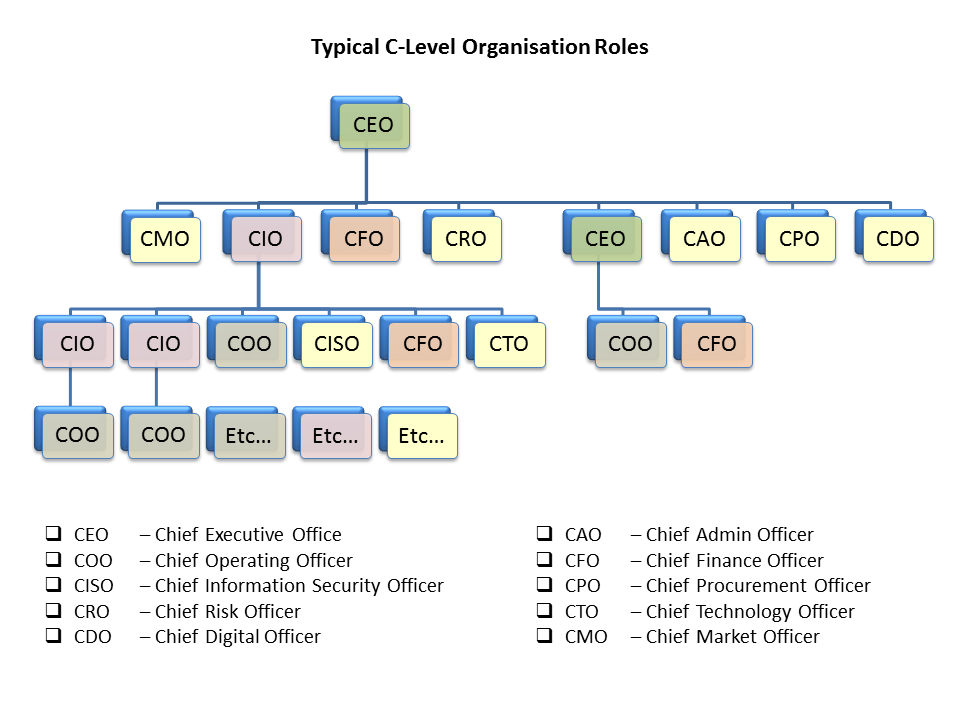

The Top 20 C Level Titles with Descriptions

Capabilities are the mindsets and behaviors an organization needs to reach and sustain its full potential. Capability building—or developing the skills an organization needs to succeed—are critical to overall performance. To thrive in today’s fast-paced environment, leaders should treat capability building as a strategic weapon to create competitive distance as well as to materially enhance employee well-being. That said, McKinsey’s CFO survey indicates that some employees perceive CFOs as a barrier to innovation. A CFO can change these perceptions by recognizing and rewarding a culture of innovation—not necessarily a culture of success. That means celebrating people who take risks and demonstrate leadership, rather than celebrating only when innovations succeed.

- Leadership experience is extremely important, and the next steps up the ladder may include roles such as controller, director of finance; internal audit manager or finance manager.

- Even with extensive knowledge and experience in the field of finance, a CFO requires proper management skills.

- When it comes to financial stewardship, part of the CFO’s job is installing a proper risk management framework to protect against fraud and unauthorized user access.

- Let’s say your growing business needs more help with finance and strategic planning.

- She has worked in multiple cities covering breaking news, politics, education, and more.

The 20 Most Common C Level Titles (Corporate)

The CTO often reports to the CEO in smaller companies or the CIO or COO in larger companies. They share the C-suite with the chief executive officer (CEO), chief operating officer (COO), and chief information officer (CIO). CFOs collaborate with investors, lenders, and key stakeholders to evaluate the company’s financial performance and drive profitability. A chief financial officer is a C-level executive position responsible for deciding how a business can best allocate resources to maximize profits. This position requires several years of professional accounting and finance experience. Here’s what to know about a chief financial officer’s needed skills, salary and how to become one.

What Is a Chief Financial Officer?

Not only does this facilitate faster SEC reporting, but it also gives the CFO more time each quarter for budgeting, scenario planning, and M&A strategizing. In today's business environment, the CFO is less of a company accountant and more multifunctional executive with financial skills. Automation of the accounting cfo title meaning function has diminished some of the CFO's accounting duties. However, the position still requires considerable financial management experience and academic training in accounting or finance. In some companies, the CFO and Finance Director positions may be held by the same individual interchangeably.

What skills are essential for today’s CFOs?

The CFO's duties include tracking cash flow and financial planning as well as analyzing the company's financial strengths and weaknesses and proposing corrective actions. The track to becoming a chief financial officer often starts with an entry-level job as an accountant or financial analyst. Next, a professional will take on leadership positions like controller or finance director to further hone their skills and spend time handling management-level responsibilities. A chief financial officer (CFO) is the corporate title for the person responsible for managing a company's financial operations and strategy.

As the CFO uses their knowledge and experience to lead a company toward economic growth and success, others may emulate the CFO’s work ethic in their own careers. A chief financial officer (CFO) plays an essential role in ensuring a business's financial health and ongoing functionality. From developing financial strategies and managing cash flow to mitigating risk and financial forecasting, they help a company work toward sustained economic success and growth. A chief financial officer typically holds a bachelor’s degree in a relevant field like accounting, finance, business or economics. They are not necessarily required to have a master’s degree, but some do bring advanced degrees.

Guiding business expansion

Developing soft skills, such as communication, leadership, and problem-solving, while gaining industry experience will set aspiring CFOs apart from the competition. For publicly traded companies in the United States, the CFO is ultimately held responsible for ensuring that the quarterly and annual financial statements are produced in an accurate, nonfraudulent manner to the U.S. This means the financial statements must be produced in accordance with generally accepted accounting principles (GAAP), as set by the Financial Accounting Standards Board (FASB). For businesses abroad, CFOs must ensure the financial statements are produced in accordance with International Financial Reporting Standards (IFRS), which are set by the International Accounting Standards Board (IASB).

This was intended to improve the government's financial management and develop standards of financial performance and disclosure. The Office of Management and Budget (OMB) holds primary responsibility for financial management standardization and improvement. Within OMB, the Deputy Director for Management, a position established by the CFO Act, is the chief official responsible for financial management. Chief financial officers oversee the financial operations and activities of a company or organization. They develop and implement financial plans, assess financial data, and report on finances to colleagues, investors, and regulatory bodies, as needed. In my opinion, the most important skills for any C-level position are communication and empathy.

The CFO and finance team can also model good financial and team-building practices for teams across the entire organization. This can include demonstrating to other teams the linkages among individual, team, and organizational performance. CFO may stand for chief financial officer—but long gone are the days when the CFO’s purview was just finance. The primary function of a controller is to maintain and operate the books, looking back at data already generated. Like CFOs, controllers usually have accounting or finance backgrounds and start their careers as accountants and auditors.

However, CFOs are required to work closely with the other senior executives of a company, such as the CEO. These executives are sometimes referred to as the C-Suite of the company, representing the company’s highest level of decision-making. Although the CFO is typically subordinate to the CEO in the corporate hierarchy, CFOs will generally be the foremost decision-maker on all matters within the Finance department of their firm. The C-suite refers to a company’s top management positions where the “C” stands for “chief.” Various chief officers such as the CEO, CIO, and CFO are the occupants of the C-suite.