Trading on Plus500 — Review of Plus500 WebTrader and Forex Broker of 2021

Long gone were the times when stock exchanges were oozing with traders and brokers. Then, digitisation happened, and online trading platforms took the lead. Through these platforms, traders and brokers crack deals, sitting in the comfort of their homes. These platforms have revolutionised the trading scenario.

One of such platforms is Plus500. Plus500 is a digital or online broker with regulated mechanisms for efficient trading. It deals in trade for contracts-for-difference (CFDs) on commodities, indices, forex ETFs and shares. This is the review of Plus500. It is very important to read this review. Because it would help, you choose a credible trading platform for yourself.

What is Plus500?

Plus500 operates on the global level and has built its credibility among the traders and brokers’ community over time. Plus500 Ltd was established back in the year 2008. It is listed on the London Stock Exchange, where it is publicly traded. It has also won the trust of retail investors globally. With the best leaders in the field, Plus500 provides an array of CFD instruments for trading. In addition, extensive market research and high-tech trading tools power the trading at Plus500.

In what countries or regions does Plus500 operate?

Plus500 is a reputable online trading platform at a global level. Plus500 operates in over 50 countries globally. In addition, it provides the ease of operating in 31 languages. Below the countries are mentioned in which trading with Plus500 is possible. Check if your country is there on the list. If yes, take the opportunity and change your game.

Plus500 countries are:

A: Argentina, Andorra, Austria, Australia & Asia/Pacific Region

B: Bahrain & Bulgaria

C: Columbia, Costa Rica, Chile, Cyprus, Czech Republic, Croatia & Columbia

D: Denmark

E: Estonia

F: France, Finland, French Guiana & France Metropolitan

G: Greece, Gibraltar, Germany & Guadeloupe

H: Hungary & Hong Kong

I: Ireland, Iceland, Israel, Isle of Man & Italy

K: Kuwait

L: Lithuania, Liechtenstein, Latvia & Luxembourg

M: Malta, Macau, Malaysia, Martinique & Monaco

N: New Zealand, Norway & Netherlands

O: Oman

P: Poland, Panama & Portugal

Q: Qatar

R: Romania & Reunion

S: Seychelles, Singapore, Slovakia, Slovenia, Spain, South Africa, South Korea, Saudi Arabia, Switzerland & Sweden

T: Taiwan

U: Uruguay & United Kingdom

In all these countries, Plus500 has built its reputation and credibility with its advanced tools for CFD. This long list of countries shows that successfully Plus500 operates globally.

What Plus500 offers?

Being the leading online broker, Plus500 offers Contracts-for-difference (CFDs). Plus500 clients get to trade over 2000 CFDs in leading market categories. In addition, it deals with cryptocurrencies, commodities, ETFs, indices, options and shares. All of these things are offered on a centralised trading platform.

In addition, Plus500 offers high-tech CFD instruments. These instruments are applicable to various asset classes. Let us discuss these CFD instruments below. However, please note that some of these instruments might not be available in your country or region.

CFD Instruments by Plus500

Cryptocurrency CFDs: Crypto CFD trading happens round the clock of Plus500. Plus500 caters for a wide variety of cryptocurrencies for trading online.

Commodity CFDs: When it comes to commodities trading, Plus500 offers more than 20 commodities CFDs. These include categories such as energy commodities (oil, gasoline etc.), agricultural commodities (wheat, rice or coffee) and precious metal commodities that include gold and platinum.

Forex CFDs: Plus500 offers around 60 currency pairs when it comes to Forex CFDs. The three major currency pairings are GBP/USD, EUR/GBP and EUR/USD.

ETF CFDs: Plus500 covers around 90 exchange trading funds (ETFs). Plus500 brokers can monitor the prices with a user-friendly platform. Some of the ETFs covered are VXX Volatility and SPDR USA 500.

CFDs Options: With over 20 popular stocks, currency pairs and indices, Plus500 offers CFDs with call and put options.

Indices CFDs: Plus500 also caters for the CFDs on indices to trade that globally cover the stock market indices. Some of these are USA 500, NASDAQ 100, ASX 200, France 40 and UK 100.

CFDs Shares: Plus500 enables you to trade CFDs on around 1000 shares from various countries such as the USA, UK and Germany.

This wide array of CFD instruments shows the expertise of Plus500 in CFD dealings. Moreover, it shows how considerate and comprehensive is Plus500.

Some Facts about Plus500

Now, we all know how widespread are the network and features of Plus500. Let us now learn more about Plus500. It would help you to develop a better understanding of Plus500. We have some striking facts about Plus500 that you might not find easily in other online broker or trading platforms. Let us get started.

- Highly regulated trading mechanisms to ensure safety.

- A wide range of asset classes available.

- Operates in 50 plus countries.

- Offers three types of trading accounts: Demo, Real and Professional.

- Efficient Stock Exchange Facilities available.

- The interface is very user-friendly. Ideal for both beginners and advanced users.

- Reasonable and industry competitive charges or fees.

- New traders can initiate with a demo Plus500 account at Plus500. Later, if things go great, the account would be verified in a few business days for real money. This is the best thing about Plus500.

What are the Pros and Cons of Plus500?

Plus500 reviews provide honest and accurate insights about the online trading platform. The review presents the pros and cons of Plus500 below. We are aware that no trading platform is perfect. Each of them has its own drawbacks and plus points.

Pros

- Mobile-Friendly Trading Platform.

- User-Friendly user interface.

- Free of cost Lifelong Demo Plus500 Account.

- Highly Credible and popular among the trade community.

- Plus500 has a score of 90/100 in multiple broker trust ratings.

- Provides 2000 plus CFDs for trading in 7 Asset Classes.

- Highly authorised and regulated by various global and regional authorities.

- No direct fees or charges.

- Market competitive pricing.

- Provides a wide array of instruments.

- Operates globally in 50 countries.

- Provides Market Research and Analytics Tools.

- Plus500 provides risk management tools as well.

Cons

- No Customer Support through call.

- Charges an inactivity fee of $10 if your account shows no activity for 3 straight months.

- Lack of automation and technical features.

- Long waiting periods for money withdrawal. In most cases, it takes 7 days.

- Plus500 only offers CFDs. Limitation in terms of products offered.

- Lack of training and education facilities.

- The web-based interface is not customisable at all. This might cause monotony.

Checkout Plus500 here

Fees of Plus500

More in the Plus500 review, let us now discuss the charges or fees of this trading platform. Plus500 charges comparatively low trading fees. This is a key factor that makes Plus500 stand out from the rest. Plus500 provide so much leverage when it comes to charging fees.

Plus500 would not charge a fee on the first five withdrawals per month. This benefits beginners or traders with small capital.

In addition, Plus500 does not ask for any commission or trade fees. The reason is that Plus500 makes its money from the selling of Bid & Ask spread betting of the CFD. This also applies to the currency pairs offered by Plus500.

The spread in the process is referred to a certain amount you pay above the quoted price for buyers. Alternatively, you receive less amount than the quoted price. Some of the average spreads are as below:

- Forex: 0.6 pips is charged per EURO USD Trade.

- S&P 500: The average spread cost is 0.45.

- Europe 50: Average cost for this is one.

Please note that the spread varies according to the CFD instrument. However, there are certain spreads that remain fixed. The average cost inculcated is low for brokers. This is based on the hypothetical calculation of leverage in trading, capital invested and position.

Other Types of Fees at Plus500

Although, Plus500 does not charge any fee for trading. There are certain types of fees or charge that are applicable. Let us see below:

- Inactivity Fee: Plus500 charges $10 per month for inactivity. This charge is applicable when there is no activity on an account for 3 months.

- Currency Conversion Charge: This charge is up to 0.5% of the loss or profit in the trade. This applies to the usage of instruments for cases that involve a difference in currency.

- Overnight Fees or Funding: The nature of the charge differs for each instrument. This charge is applicable when a position remains open after a certain period.

- Guaranteed Stop Order Fees: This charge is variable in nature. It is charged through a wider spread. The aim is to guarantee that a position is closed at a certain price.

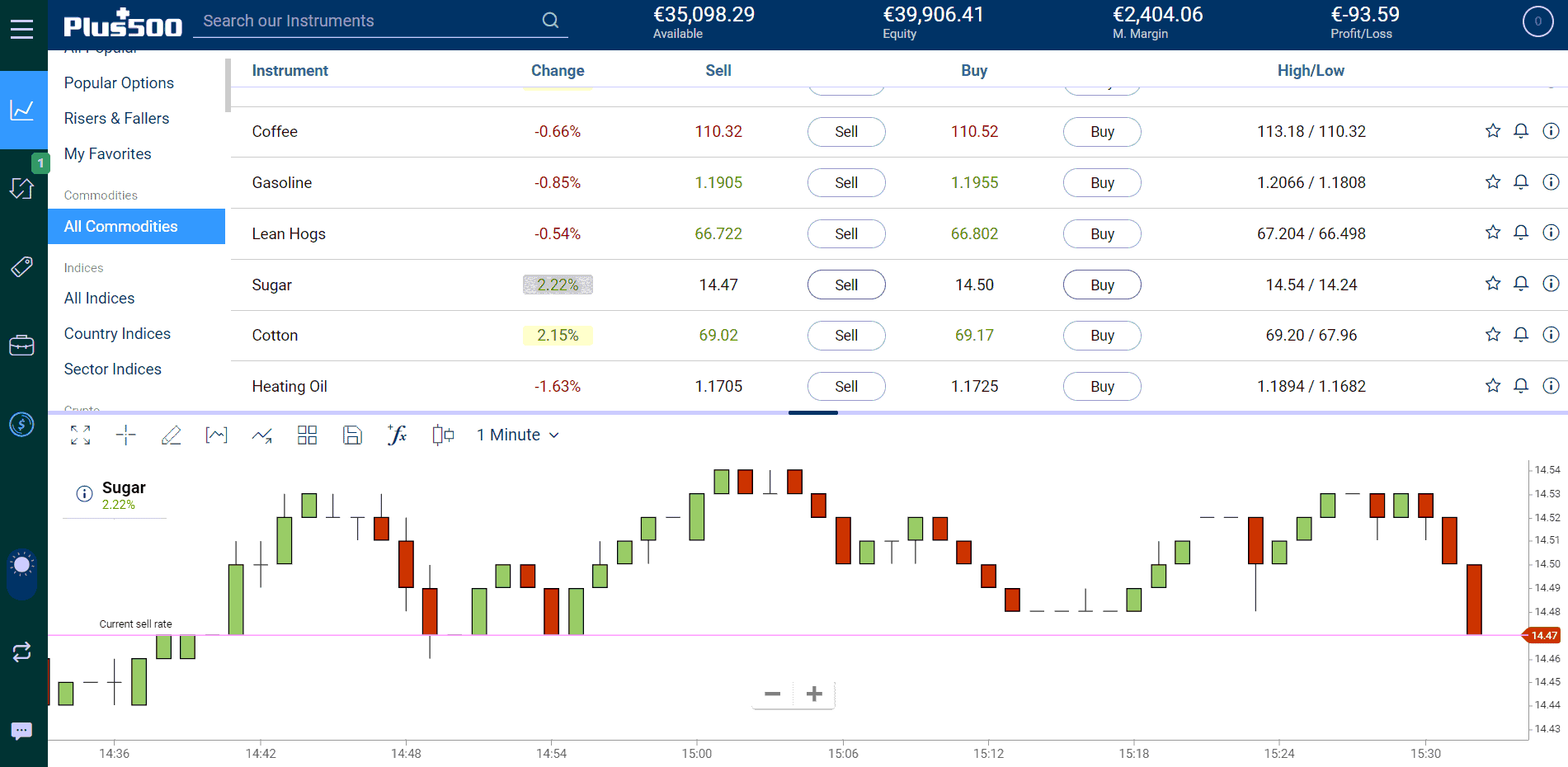

Plus500 WebTrader

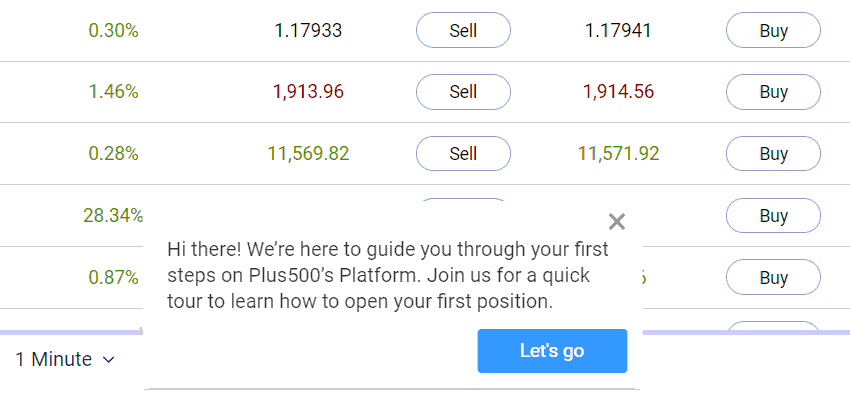

Plus500 provides an amazing web-based trading platform. It comes with a super friendly user interface with interactive features. Plus500 provides a centralised pool for trading CFDs. The interface displays the entire essential and core insights with smart analytics. You can monitor historical transactions, positions, reports, fees, graphs and relevant information regarding your account. It is just as if you are visiting a stock exchange at home. In addition, it provides a one-stop trading account.

The web-based trading platform allows you to access your account through a two-step login process. This makes it two layers of tight security for your account. The web trader allows you to swiftly switch between your demo, real and professional account. Plus500 has a smart price alert and notification system.

Let us now talk about some lacking in the web-based interface for Plus500, as the Plus500 review presents an honest picture. One of the major missing in the Plus500 web-based Trading platform is that the interface is not customisable at all. In addition, it does not feature certain advanced charting features and tools, along with the limitations of the screen layout. There are less technical analysis tools available on the web trader. Moreover, the platform does not provide any support for automated trading.

Plus500 Mobile Apps

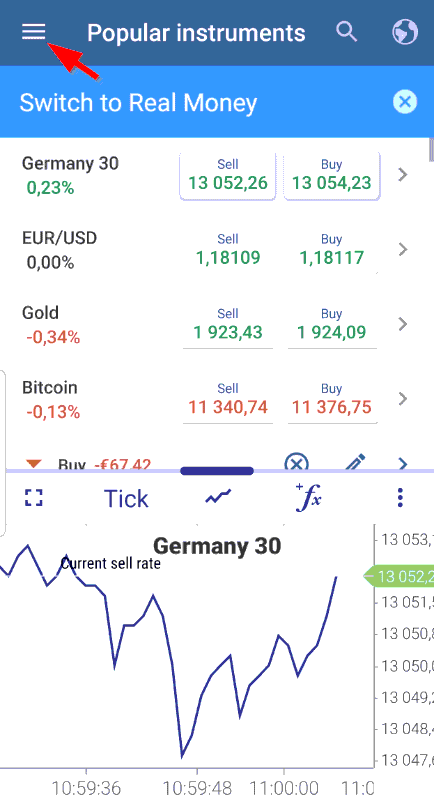

One of the best things about the Plus500 trading platforms is that it has a mobile app. This makes the Plus500 trading platform stand out from the rest. This ensures convenience and ease of access for the trader. The mobile app provides all the required features for crucial functioning. However, it does not feature all the functions provided in the web-based platform of Plus500. The basic features of the mobile app are account management, reports, charting tools and search modules. The mobile app also provides real-time quotes on currency pairs and stocks. Traders can also directly link their account to their bank using the app.

Plus500 trading platform app is available on Windows phone, IOS and Android stores. It is compatible with all operating systems as well. You can connect your smartwatch with your Plus500 app too. Plus500 trading platform app ensures security by biometric authentication, in addition to the passkey. Plus500 trading platform app provides instant operations and tracking of orders.

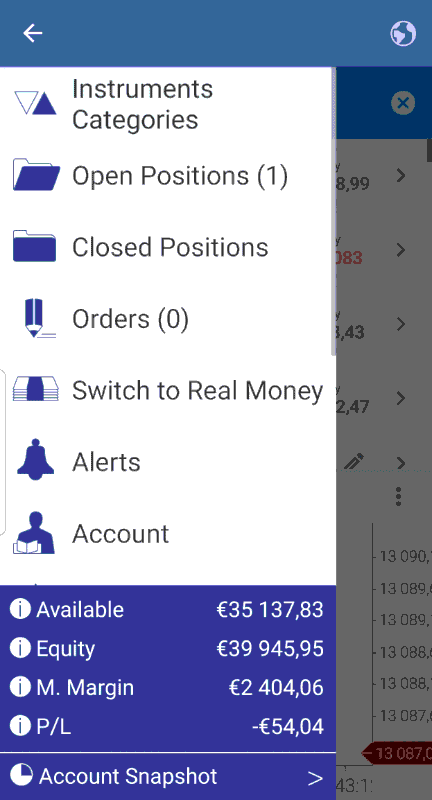

The interface of the app looks like this:

You can access all the app features and options by clicking on the menu icon. A menu will pop up on the screen. You can also switch between your accounts through this menu.

Account Types on Plus500

There are three kinds of accounts catered by Plus500. Let us discuss them below:

- Plus500 Demo Account

A demo account is one of the best features of Plus500 online trading platforms. It allows new traders or beginners to experience the trading platform before stepping into real trading. It is very easy to open a demo account at Plus500. The registration for demo accounts takes only a few minutes. It does not require any minimum deposit.

It allows the new traders to test their strategies, ideas and trading patterns on Plus500. It allows them to get familiar with the market and trade scenario. A demo account is one of the best features of Plus500. It allows you to trade with fictitious money of $40,000. Plus500 allows you to play in the field.

The demo account by Plus500 stands out. The reason is that you can keep your demo Plus500 account for an unlimited period. In addition, you do not need to have a demo account just to open a real account later. Moreover, the signup process is pretty simple and fast. You can start trading just minutes after opening.

Let us see how you can open a demo account on Plus500:

- Go to the Plus500 homepage, and you would see the following screen:

• Now, click on the option Try Free Demo. This would lead you to a signup webpage. Fill the form, click Create an Account. Enter your email address and set a passkey.

- Now, you are all set for a tour of your account.

2. Real Money Account

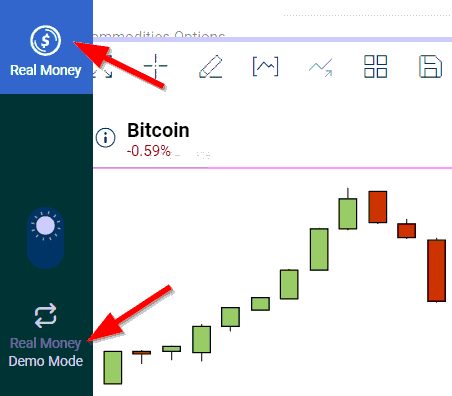

Next up, we have the Real Money account on Plus500. Now, if all the things go well in your demo account, you can opt for a real money account. Both of these accounts are similar. However, there is one key difference between the two. The difference is that in a real-money account, you trade with real money instead of fictitious money. Moreover, you get negative balance protection and client money protection as well.

Opening a real money account requires consideration, additional steps and a longer verification period. This is where the real game starts at Plus500. You can directly open a real money account by having a demo account before.

Let us learn below how to open a real money account on Plus500.

- Once again, you would go to the Plus500 homepage. Now, you would click on the Start Trading Now button.

- This would initiate the registration and verification process for the real money account. It will ask you to provide email details. In addition, it would ask you about some mandatory data such as full name, date of birth, country of residence, your CFD trade experience, financial information, employment status and your trading profile. In addition, it would ask you about your investment credentials.

- In case you already have a demo account, you can switch to a real account. The switching option is the trading platform menu, as shown below:

• Now, after completing the registration process, you have to get your real account verified. This would take time.

Real Account Verification

For the verification process, you have to provide valid documents to verify your identification, address, and funding channels. For identification, you can upload your ID, passport, driver’s license or residence permit. Whatever the document be, it must have an updated pic of yours.

For residential or official address, you can provide any valid document such as utility bills, bank statement or tax document. For verifying the sources of funds, you need to provide your bank or credit/debit card statement to Plus500.

3. Professional Account on Plus500

The third account at Plus500 is known as the Professional Account. However, this is not for everyone. The trader must meet certain criteria in order to qualify for a professional account. It is also called the premium account. This is just amazing. It provides a sense of achievement to the trader and elevates the trader in the community.

It comes with features such as negative balance protection and maximum leverage. You can switch back to your real account at any time.

Criteria to qualify for a Plus500 Professional account

The trader must meet two out of three points to get hands-on a professional account. The points are:

- Level of Work Experience: One year experience of job in the financial sector with all the relevant knowledge of products and services.

- Adequate Trading Activity: Average of ten transactions per quarter over past four quarters with Plus500 or any other credible broker.

- Portfolio Size: Financial Instrument Portfolio of €500,000 is required.

If you are lucky enough to fit this criterion, you can enjoy all the exclusive benefits of a professional account. Please note that it does not require any minimum deposit.

Minimum Deposit

The minimum deposit fund for account opening is $100. You can pay this through your debit or credit card, E-wallet and PayPal or Skrill. Please remember that the minimum deposits vary regionally.

Plus500 Deposit and Withdrawal Payment Methods

Plus500 trading platform provides three methods for money withdrawal, listed as below.

- Debit or Credit Card (the processing period depends on the bank used)

- Platforms such as PayPal and Skrill for E-wallet. (Takes 3 to 7 business days)

- Bank or Wire Transfer. (Requires 5 to 7 business days)

Please note that these methods can work on different response periods. It depends on the nature of transactions and regions. These channels can also be used for the minimum deposit transaction.

Customer Support by Plus500

Plus500 employs a dedicated and professional team for customer care. Many traders have reviewed the customer care by Plus500 positively. The customer care team works round the clock to ensure that every customer appeal is dealt with care and provides a solution.

Plus500 offers customer support through three channels: Live Chat, Email and WhatsApp. Plus500 does not offer customer care through phone call. The customer care representatives assist the clients and talk to them about the potential issues. They make sure that every client is hosted and receives a timely response. The response time varies. It depends on the complexity or nature of the issue.

A noteworthy thing here is that Plus500 is the first CFD provider to offer customer care through WhatsApp. This ensures the ease of access and response for the client.

Please note that the nature of customer care channels might vary according to the country or region.

FAQ

Safety Concerns: Is Plus500 a secure platform to trade online?

As we have discussed earlier that Plus500 is a highly regulated platform for trading CFDs. Plus500 is a highly secure platform that works in regulation with the top financial entities or authorities. Some of these authorities are the Monetary Authority of Singapore, the Financial Conduct Authority in the United Kingdom and the Australian Security and Investment Commission (ASIC). In the EU, Norway and Switzerland, the Cyprus Securities and Exchange Commission regulates the trading at Plus500.

In the state of Israel, Israel Securities Authority oversees it. In Seychelles, Seychelles Financial Services Authority regulates Plus500 SEY. In New Zealand, FMA looks after it. Plus500uk ltd is authorised by Financial Conduct Authority FRN 509909 as well. In addition, Plus500 trading makes sure that regional transparency authorities regulate it globally. In this way, the high risk of losing money is mitigated as well.

Compliance with these regulations mitigates the risks involved in online trading. This makes it a safe broker online platform. In addition, the traders at Plus500 are protected under the Financial Services Compensation Scheme (FSCS). Cy SEC. Regulates the Plus500 CY. Moreover, the Plus500 trading platform has 3 Tier-1 licenses by leading security authorities and is regulated by the financial authorities regionally.

Another thing that makes Plus500 the safest platform is that it is listed on the London Stock Exchange. In addition, it is listed in the FTSE 250 Index. These listings ensure transparency in trade using Plus500. This is also crucial for a company’s liquidity and solvency. This protects the investors’ money. This high level of regulation makes it evident that Plus500 is a very safe platform for trading.

All these regulations evidently show that Plus500 is a safe platform. However, do not forget that it is trading. There is a high risk of losing money involved. The retail investor accounts must be ready and afford to take the high risk.

Is it safe for money when trading CFDs?

For this, we would be sharing authentic remarks from FCA in the UK and European Securities and Markets Authority (ESMA). Let us start

“72% of the investor accounts lose money when trading CFDs with this provider.”

This is an authentic and up to the mark, Plus500 review. Let us tell you very clearly that there is a high risk of losing money when trading CFDs. We have a valid and authentic statement for you in this regard. 72% of the investor accounts lose money when trading CFDs with this provider. One of the reasons is that it works on short-term positions. Moreover, CFDs are complex instruments and come with chances of losing money rapidly due to the uncertainty in trading. Although Plus500 is highly authorised and regulated, you must afford to take the high risk of losing a fortune.

That is why before going for Plus500 or any provider, you should consider the high-risk stakes. You must consider whether you understand how CFDs work. You must be aware that it comes with a high risk of loss rapidly. In this regard, the role of training and education is necessary. You must consult an authorised financial services provider too for this. However, the best practices at Plus500 make sure to mitigate the risks involved.

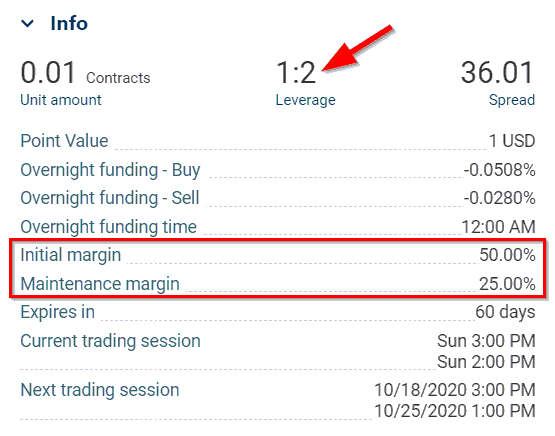

What is the nature of Leverage in CFD trading at Plus500?

Leverage is one of the key elements of CFD trading at any platform. The purpose of leverage is to provide the traders with exposure to the financial markets by self-funding. That is only a fraction of the total trade value. There are certain levels or ratios of leverage. These levels vary according to the geographical location of the trader and global or regional regulations.

Leverage levels or ratios for retail accounts are stated as below:

- Forex: 30:1

- Stock Index: 20:1

- Stocks: 5:1

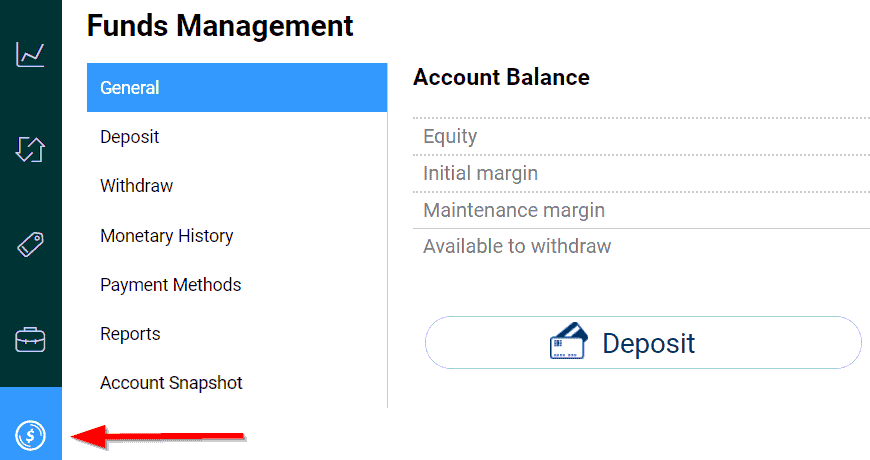

For understanding, a 20:1 leverage ratio means that the trader is able to borrow $20 per each $1 committed. The latest leverage ratio offered by Plus500 is 30:1. Your Plus500 interface would display the leverage ratio, as shown below:

There is a drawback to the leverage feature. It is that the leverage ratio stands fixed in case the trader intends to reduce the risk adjoined by the position. This involves risk as well.

It is estimated that with complex leverage instruments, 72% of the retail investor accounts lose money when trading rapidly due to leverage. You must afford to take a high risk of losing your money in order to take the leap.

Does Plus500 provide any research feature for traders?

No, Plus500 does not offer the facility of research such as regular market commentary, daily insights monitoring or any forex news. So, you have to do all the research yourself. Research is an essential element. It sets the tone of your trade. Before using any provider, you should consider the availability of the research feature.

Although there is no distinct feature in Plus500, Plus500 does provide basics. It provides you with access to and data about the economic calendar and Yahoo Finance. However, there is a Trader’s Sentiment tool that is a plus point. This tool shows the figures and percentage of the traders involved in the trade.

Now, that you made it that far: Try Plus500 for free